Introduction

In the realm of personal finance, securing a loan can be a game-changer, and one crucial player in this financial chessboard is the Credit Information Bureau (CIBIL) score. At the heart of every successful personal loan application lies a comprehensive understanding of how CIBIL scores influence approval. In this article, we unravel the intricate tapestry of the role CIBIL scores play in securing personal loans, providing you with a roadmap to financial success.

Understanding CIBIL Scores

What is a CIBIL Score?

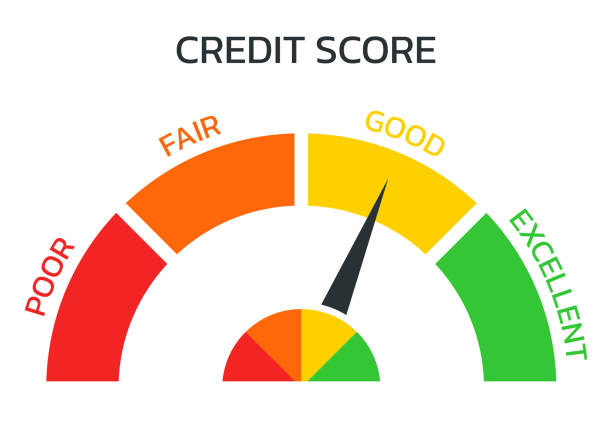

A CIBIL score is a three-digit numerical representation of an individual’s creditworthiness, ranging from 300 to 900. The higher the score, the better the creditworthiness, and consequently, the more favorable the terms for a personal loan.

Factors Influencing CIBIL Scores

1. Credit History

The backbone of a CIBIL score, credit history reflects your past credit behavior. Timely repayments and responsible credit management contribute positively, while defaults and late payments can mar your score.

2. Credit Utilization Ratio

This ratio compares your credit card balances to the credit limit. Maintaining a lower credit utilization ratio can positively impact your CIBIL score.

3. Length of Credit History

The duration of your credit history matters. A longer credit history provides a more comprehensive picture of your financial behavior.

The CIBIL Score-Personal Loan Nexus

1. Higher Scores, Better Rates

Lenders view high CIBIL scores as a testament to your creditworthiness. As your score ascends, you’re likely to secure a personal loan at lower interest rates, saving you money in the long run.

2. Quick Approvals and Higher Loan Limits

A stellar CIBIL score expedites the loan approval process. Moreover, lenders are more inclined to offer higher loan amounts to individuals with proven financial responsibility.

Strategies to Boost Your CIBIL Score for Personal Loan Success

1. Timely Repayments

Consistently paying bills and loans on time is a cornerstone for a positive credit history. Automating payments can be an effective strategy.

2. Credit Mix Management

Maintaining a diverse credit portfolio, including credit cards, loans, and retail accounts, showcases your ability to manage different types of credit responsibly.

3. Regularly Monitor Your Credit Report

Vigilance is key. Regularly checking your credit report allows you to identify and rectify any discrepancies that might affect your CIBIL score.

Conclusion

In the dynamic landscape of personal finance, a deep understanding of the symbiotic relationship between CIBIL scores and personal loans is paramount. Armed with this knowledge, you can navigate the financial terrain with confidence, securing not just loans but also favorable terms that align with your long-term financial goals. Boosting your CIBIL score is not just a numerical game; it’s a strategic move toward financial empowerment and stability.