In today’s fast-paced world, financial stability is essential to achieve our dreams and aspirations. However, a low credit score can often become a roadblock, making it challenging to secure loans and financial assistance. If you find yourself in a situation where your CIBIL score is hovering around 550, don’t lose hope just yet! This article will guide you through the possibilities of obtaining a personal loan with a CIBIL score of 550 and provide valuable insights on improving your creditworthiness.

Personal Loan for CIBIL Score of 550: A Brief Overview

A personal loan is a versatile financial tool that can help you meet various expenses, such as medical emergencies, debt consolidation, home renovations, or education fees. However, most traditional lenders heavily rely on credit scores, including the widely recognized CIBIL score, to assess an individual’s creditworthiness. A CIBIL score is a numerical representation of your credit history and financial behavior, ranging from 300 to 900. A score of 550 is considered relatively low, but it doesn’t mean you’re entirely out of options.

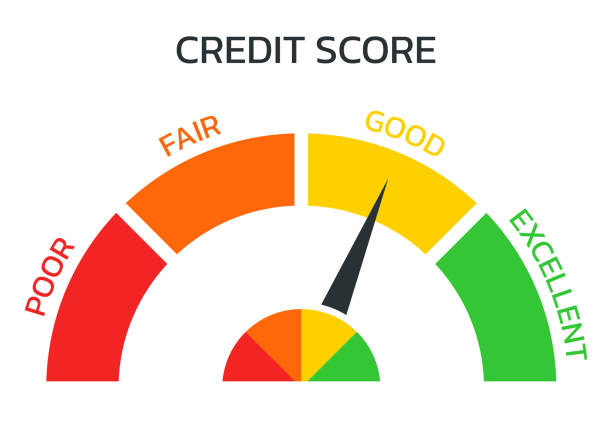

Understanding CIBIL Score

Before we delve into the solutions, let’s understand the significance of the CIBIL score. Your CIBIL score is a reflection of your creditworthiness and is determined by factors such as your repayment history, credit utilization, credit mix, and the duration of your credit history. Lenders often perceive a low score as an indicator of higher credit risk, making it challenging to secure loans with favorable terms and conditions.

Impact of a Low CIBIL Score on Personal Loan Approval

When applying for a personal loan with a low CIBIL score, you may face certain challenges. Traditional lenders typically prioritize borrowers with higher credit scores, as it reduces the risk of default. A low CIBIL score may lead to loan rejections, higher interest rates, or stringent repayment terms. However, there are alternative options available that cater specifically to individuals with lower credit scores.

Options for Personal Loans with a CIBIL Score of 550

Although obtaining a personal loan with a CIBIL score of 550 from a conventional lender can be challenging, there are still viable options to explore. Here are a few alternatives worth considering:

1. Online Lenders: Online lending platforms have emerged as a popular choice for individuals with lower credit scores. These platforms often have more flexible eligibility criteria and consider additional factors beyond just the credit score, such as income and employment stability.

2. Secured Personal Loans: If you have valuable assets like property, gold, or fixed deposits, you can leverage them as collateral to secure a loan. Secured personal loans offer higher chances of approval, as the lender has an assurance in the form of collateral.

3. Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers directly with individual lenders. These platforms consider a broader range of factors when evaluating loan applications, making them more inclusive for individuals with lower credit scores.

Remember to carefully assess the terms and conditions, interest rates, and repayment schedules before finalizing any loan agreement. Compare multiple lenders and explore customer reviews to ensure you make an informed decision.

How to Improve Your CIBIL Score

Improving your CIBIL score is crucial for your long-term financial health. While it may take time and consistent efforts, the benefits are worth it. Here are some steps you can take to enhance your creditworthiness:

1. Review Your Credit Report: Obtain a copy of your credit report from credit bureaus like CIBIL and carefully review it for errors or discrepancies. Dispute any inaccuracies to ensure your score reflects your actual creditworthiness.

2. Pay Bills on Time: Late payments can significantly impact your credit score. Ensure timely repayment of credit card bills, EMIs, and other loan obligations to demonstrate responsible financial behavior.

3. Reduce Credit Utilization: Aim to keep your credit utilization below 30% of your available credit limit. High credit utilization indicates dependency on credit and can negatively affect your score.

4. Diversify Your Credit: Maintaining a healthy mix of credit, including credit cards, loans, and other forms of credit, can positively influence your credit score over time.

5. Avoid Frequent Credit Applications: Multiple credit inquiries within a short period can raise concerns among lenders. Apply for credit only when necessary and avoid unnecessary credit applications.

Tips for Getting a Personal Loan with a Low CIBIL Score

When applying for a personal loan with a low CIBIL score, consider the following tips to increase your chances of approval:

- Explore Online Lenders: Online lenders often have more lenient eligibility criteria and cater to borrowers with lower credit scores.

- Offer Collateral: Providing collateral can act as a security for the lender, reducing the risk associated with your low credit score.

- Demonstrate Stable Income: Highlight your stable income and employment history to reassure lenders of your repayment capacity.

- Apply with a Co-applicant or Guarantor: Adding a co-applicant or a guarantor with a better credit profile can strengthen your loan application.

- Focus on Small Loan Amounts: Applying for smaller loan amounts may increase the likelihood of approval, as the risk for lenders is reduced.

Common Mistakes to Avoid when Applying for a Loan

When seeking a personal loan, it’s crucial to avoid common mistakes that can hinder your chances of approval. Here are some pitfalls to steer clear of:

Inaccurate Application Information: Provide accurate and updated information while filling out your loan application.

Multiple Loan Applications: Applying for multiple loans simultaneously can negatively impact your credit score and raise concerns among lenders.

Ignoring the Fine Print: Read and understand the terms and conditions of the loan agreement thoroughly before signing. Pay attention to interest rates, repayment schedules, and any additional fees or charges.

Borrowing Beyond Your Repayment Capacity: Borrow only what you can comfortably repay within the specified tenure. Taking on excessive debt can lead to financial stress and potential default.

Ignoring Alternative Lenders: Traditional banks may have stricter policies for individuals with low credit scores. Consider alternative lenders who specialize in catering to borrowers with credit challenges.

By avoiding these common mistakes, you can present yourself as a responsible borrower and enhance your chances of obtaining a personal loan.

Benefits of Applying for a Personal Loan

Despite the challenges posed by a low CIBIL score, there are significant benefits to securing a personal loan:

1. Financial Flexibility: A personal loan provides you with the flexibility to use the funds for various purposes, including emergencies, debt consolidation, or planned expenses.

2. Quick Disbursement: Online lenders and alternative financing options often offer faster loan disbursal compared to traditional banks, ensuring timely access to funds.

3. Credit Building Opportunity: By responsibly repaying your personal loan, you can gradually rebuild your credit score and enhance your future borrowing prospects.

4. Consolidation of Debts: Personal loans can be used to consolidate multiple debts into a single, manageable installment, simplifying your repayment process.

5. Lower Interest Rates: While interest rates may be higher for individuals with low credit scores, personal loans can still provide better rates compared to credit cards or payday loans.

Frequently Asked Questions (FAQs)

1. What is a CIBIL score?

A CIBIL score is a numerical representation of an individual’s creditworthiness, based on their credit history and financial behavior. It ranges from 300 to 900, with higher scores indicating better creditworthiness.

2. Can I get a personal loan with a CIBIL score of 550?

While it may be challenging to secure a personal loan from traditional lenders with a CIBIL score of 550, there are alternative options available. Online lenders and secured personal loans can provide viable solutions.

3. How long does it take to improve a CIBIL score?

Improving a CIBIL score is a gradual process that requires consistent efforts over time. Depending on individual circumstances, it can take several months or even years to witness significant improvements.

4. Are there any specific personal loan options for individuals with a low CIBIL score?

Yes, there are specific personal loan options available for individuals with low CIBIL scores. Online lenders and peer-to-peer lending platforms often cater to borrowers with lower credit scores.

5. Can I get a personal loan without a credit check?

Traditional lenders typically perform credit checks when assessing loan applications. However, certain alternative lenders may offer personal loans without strict credit checks, focusing more on other factors like income and employment stability.

6. What are the benefits of a personal loan for individuals with a low CIBIL score?

A personal loan for individuals with a low CIBIL score offers financial flexibility, the opportunity to rebuild credit, quick disbursal, and the ability to consolidate debts into a single manageable installment.

Conclusion

Obtaining a personal loan with a CIBIL score of 550 may present its challenges, but it’s not an impossible feat. By exploring alternative lending options, improving your credit score, and being mindful of common mistakes, you can unlock financial opportunities and overcome temporary setbacks. Remember to compare lenders, understand the terms and conditions, and assess your repayment capacity before proceeding with a loan application. With determination, responsible financial behaviour, and a focus on improving your creditworthiness, you can pave the way towards a brighter financial future.

Read Also : Get Instant Personal Loans Without A CIBIL Score